An Exceptionally High-Grade Flake Graphite Project in Southern Greenland

An Exceptionally High-Grade Flake Graphite Project in Southern Greenland

The Amitsoq Graphite Project is located in the Nanortalik region of southern Greenland and is one of the highest-grade graphite deposits in the world

It has a total inferred, indicated and measured JORC Resource of 23.05 million tonnes (Mt) at an average grade of 20.41% Graphitic Carbon (C(g)), giving a total graphite content of 4.71 Mt. The Resource contains a lower graphite layer that has a JORC resource of 16.88 Mt at a grade of 21.51% with 3.634 Mt of contained graphite. For context, deposits with compliant resources above 20% C(g) are scarce, with the average global grade of graphite resources being just 8.45%.

GreenRoc is focused on fast-tracking the development of Amitsoq to create a new, responsibly mined source of high-quality graphite that can support the rapidly growing EV battery market. Graphite is projected to be in severe deficit before the end of this decade.

The Licence

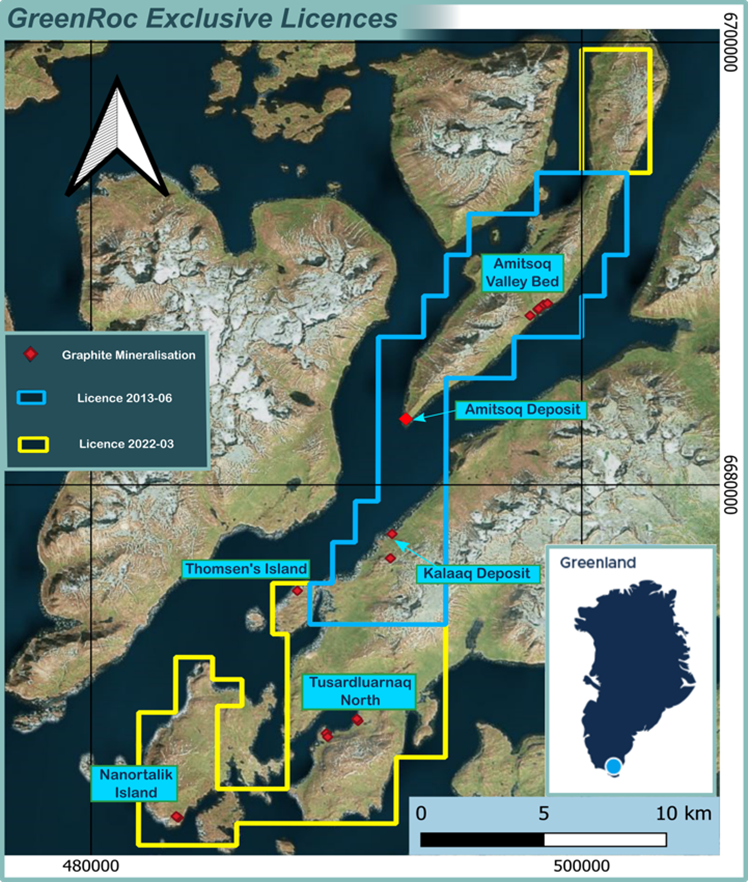

Amitsoq is owned and operated by GreenRoc’s wholly owned subsidiary, Obsidian Mining Limited, under Mineral Exploration Licence 2013-06.

GreenRoc received approval from the Government of Greenland in October 2023 to expand its Mineral Exploration Licence 2013-06, encompassing the high-grade Amitsoq Graphite Deposit in southern Greenland. This has huge significance in securing access to the enlarged area for future infrastructure development and its potential for additional high-grade graphite deposits akin to those at Amitsoq.

Successive field seasons have confirmed the presence of two priority target zones: the Amitsoq Deposit to the north, which is the site of a former graphite mine and where the current project resource has been defined, and the yet undrilled mainland Kalaaq Deposit to the south, where grades of 17.4 to 33.1% graphite have been returned.

Historic graphite occurrences have also been confirmed in four new zones of interest, broadly forming a north-south tract some 30km long. The four zones comprise Nanortalik Island, Tusardluarnaq North and Thomsen’s Island, which sit within the southern portion of the licence, and Amitsoq Valley Bed, which lies ~7km NE of the established Amitsoq Island deposit.

On Nanortalik Island, graphitic grades of 23.4% C(g) to 32.5% C(g) have been reported from eight samples over a strike length of ~800m and the graphite bodies remain open along strike to the north and south. At Amitsoq Valley Bed, a new 1km long zone of graphite-bearing rocks with values up to 24.9% C(g) has been identified.

The Resource

The project has a current JORC Resource of 23.05 million tonnes at an average grade of 20.41% C(g), giving a total graphite content of 4.71Mt (2023 MRE). The project includes 1.26 Mt of Measured Resource, this being the highest confidence pre-Reserves category. Indicated Resource of 6.12 Mt and an Inferred Resource of 15.67 Mt.

2023 Mineral Resource Estimate

| Mineral Resource Category | Tonnage (Mt) | Grade (Cg%) |

| Measured | 1.26 | |

| Indicated | 6.12 | |

| Inferred | 15.67 | |

| Total | 23.05 | 20.41 |

One third of the contained graphite falls within the higher Measured and Indicated categories, an important validation of Amitsoq’s fundamentals.

Consistently high-grade graphite intersections have been confirmed with significant mineable widths (more than 2.0m true thickness) present within graphite layers, consisting of the Lower Graphite Layer (‘LGL’) and Upper Graphite Layer (‘UGL’). The LGL has a maximum minable thickness of >20.77m running at 23.32% graphite (drill hole AM_DD_035).

The consistency of the very high graphite grades in both of the LGL and UGL ore bodies show that Amitsoq has the potential to be a significant graphite producer. Crucially, the UGL orebody remains open towards the west and south, while the LGL remains open towards the south, west and north, providing significant further upside opportunity.

Preliminary Economic Assessment

The Amitsoq Graphite Project has received positive validation through a Preliminary Economic Assessment (PEA) conducted to international NI 43-101 standards by SLR Consulting Ltd.

The PEA underscores the robust economics of the project:

- Pre-tax Net Present Value of US$235M (at 8% discount)

- Pre-tax Internal Rate of Return of 31.1%

- 22-year Life of Mine

- 4-year payback period

- Average annual production of 77,000t of concentrate at a minimum 94% grade,

- Amitsoq is poised for global significance.

The strategic mine plan, focusing on the Lower Graphite Layer, ensures the potential for future expansion or extension to the life of mine using the considerable resources from the Upper Graphite Layer.

GreenRoc’s commitment extends beyond mining, aiming to elevate our graphite concentrate production into active anode material for electric vehicle batteries.

To address the projected graphite supply deficit and concerns over an overreliance on Chinese graphite in the global EV supply chain, Amitsoq is emerging as a crucial source of high-purity spherical graphite for the European battery industry. The strong economic results from the PEA provide independent validation of the project’s potential to become a globally significant producer of graphite concentrate.

Amitsoq Project Economics

Initial Capital Expenditure (Capex), totals US$131M, encompassing construction and commissioning, with a prudent 25% contingency of US$26M.

Operating costs are US$111 per tonne of milled ore, covering mining, processing, and general administration.

An additional US$10/t is allocated for shipping concentrate to the port of destination, summing up to a comprehensive US$121/t.

The project’s financial outlook is robust:

- Total gross revenue of US$2.1Bn over a 22-year Life of Mine

- Undiscounted net pre-tax cash flow of US$794.7M

- Based on a forecasted average basket graphite price of US$1250/t for 94% concentrate from 2028-2033.

The pre-tax Net Present Value at an 8% discount rate (NPV8) reaching US$235M and an Internal Rate of Return (IRR) of 31.1%.

| Cash Flow | Discount rate | Units | Value |

| Pre-Tax IRR | % | 31.1% | |

| Pre-tax NPV at 6% discounting | 6.0% | US$ ‘000 | $314,441 |

| Pre-tax NPV at 8% discounting | 8.0% | US$ ‘000 | $235,308 |

| Pre-tax NPV at 10% discounting | 10.0% | US$ ‘000 | $177,115 |

| After-Tax IRR | % | 26.7% | |

| After-tax NPV at 6% discounting | 6.0% | US$ ‘000 | $243,663 |

| After-tax NPV at 8% discounting | 8.0% | US$ ‘000 | $179,353 |

| After-tax NPV at 10% discounting | 10.0% | US$ ‘000 | $132,224 |

Development

GreenRoc is focused on harnessing the momentum of a positive PEA to fast-track Amitsoq to graphite production and become an important supplier of raw materials to the EV industry in North America and European markets, given its strategically important location.

Based on the quality of graphite grade and thickness of deposit, coupled with the resource’s simple architecture, mine planning operations at Amitsoq are expected to be relatively simple from a mining-technical viewpoint, with a minimum of waste rock produced. These are important factors for the construction and operation phases but also in relation to the cost implications of building a mine at Amitsoq, as energy costs could be greatly reduced.

GreenRoc has a defined strategy in place to advance Amitsoq to development status. This includes the appointment of ey consultants to progress critical work studies, including the completion of an Environmental Impact Assessment (EIA) and a Social Impact Assessment (SIA) so that formal applications for exploitation licences can be submitted to the Greenland Government.

A Phase III drilling programme in 2024 aims to upgrade graphite resources and vital geotechnical data for the Pre-Feasibility Study (PFS), set to commence in H2, 2024. The PFS, building on the PEA, will produce detailed engineering, optimising mine and processing design while fine-tuning inventory, capital, and operating cost estimates.

Simultaneously, 2024 should see the completion of the EIA and SIA for Amitsoq, enabling an Exploitation License application to be made —a pivotal step towards commercial production.

In parallell, GreenRoc’s commitment extends to a Feasibility Study on a graphite anode material processing plant, supported by Benchmark Mineral Intelligence, ProGraphite, SLR, and Decision Risk Analytics, and bolstered by a £250k grant from the Advanced Propulsion Centre. We anticipate the conclusion of this comprehensive study in Q2, 2024, propelling GreenRoc towards the forefront of sustainable mineral exploration and production.

Commercialisation and the EV market

Micronisation and spheronisation testwork has confirmed that Amitsoq graphite easily upgrades to a high-quality spherical graphite product, exhibiting good commercial properties. Spherical graphite is used by EV battery manufacturing companies as the anode material in batteries. The anode sector is the fastest growing market for graphite and the ability to upgrade natural graphite to a high purity spherical graphite product is a prerequisite for entry into that market. Analysts suggest a serious graphite deficit is looming, further heightened by the Chinese Government’s decision to implement export restrictions on graphite from 1 December 2023.

Testwork conducted by ProGraphite GmbH in Germany confirmed:

- A primary concentrate product of at least 96.5% graphite can be achieved by simple flotation processing.

- The concentrate micronised easily and with relatively little energy input, resulting in a very uniform micronised material.

- Two spherical graphite products were then produced, with median diameters of 15 and 19 micrometers, respectively.

- The physical target values for spherical graphite, such as narrow particle size distribution and high tap density, were achieved and exceeded.

- Leaching of the Amitsoq spherical graphite resulted in 99.97% purity – thus exceeding the battery industry requirement of better than 99.95%.

Significantly this purity was achieved using both hydrofluoric acid and alkaline leaching, which gives more options for the purification design. .

It is notable that testwork found that only four flotation cleaning stages were required to reach a primary concentrate product of at least 96.5% graphite. This is very positive as it suggests that our future processing plant in Greenland will be able to run with a reduced number of cleaning stages compared to what had previously been assumed. This will shorten processing time, conserve energy and reduce the costs of production.